- Home

- Hiring an Agency vs Privately

Hiring and Agency vs Private Caregiver:

The Main Issues associated with hiring a private individual as a caregiver:

1) Dispute with private Caregiver: (Lack of policies and procedures)

a) Must be handled by family directly if caregiver starts to make increasing demands

b) Many times issues will not be resolved or will be overlooked by the family because there is the fear of having to go through the entire hiring process again.

c) The caregiver starts to take additional liberties, becomes too comfortable or lazy.

d) The caregiver starts to become manipulative and controlling in the situation.

2) Client Needs change:

a) Private caregivers may not be available if a client’s needs increase or change.

b) Private caregivers may need to look for other work if the needs decrease resulting in the loss of the caregiver and having to find a replacement.

3) Providing care in a different setting:

In the event a loved one is admitted to the hospital or respite stay at a nursing or retirement home, many require the caregiver to have separate liability insurance to work in the facility/hospital setting.

4) If private caregiver is injured on the job:

Did you register wtih WSIB? Are you liable for compensation unless proper insurance is obtained?

5) Definition of work time and the number of hours required to work.

As an employer you must follow the various payroll and employment standards acts to ensure that employees are paid properly and you are not inadvertently exploiting them. If taxes and payroll are not performed properly or a dispute with pay from a caregiver:

a) Potential issues with Canada Revenue Agency.

b) Employment Standards Act.

6) Defining contractor vs. employer/employee relationship.

Many feel that you hire an individual privately “ie a contractor” you do not have to pay Payroll taxes and withhold taxes. In the majority of situations when hiring in home care this is false. Because you have entered an employee/employer relationship as defined by CRA.

If your caregiver does not provide you with a receipt (which means they are probably not claiming the income on their taxes), you are limited in your ability to claim deductions from your taxes and may put you at risk for an audit from CRA.

7) Did you open a payroll program account with CRA?

Are you prepared to ensure that you are collecting the proper paperwork from the caregiver? Calculate payroll deductions, prepare payroll cheques, provide pay stubs and remit payments to the government for withholding taxes. (Both employee and employer required.) Employers are required to pay on top of wages EI, CPP as employer contributions.

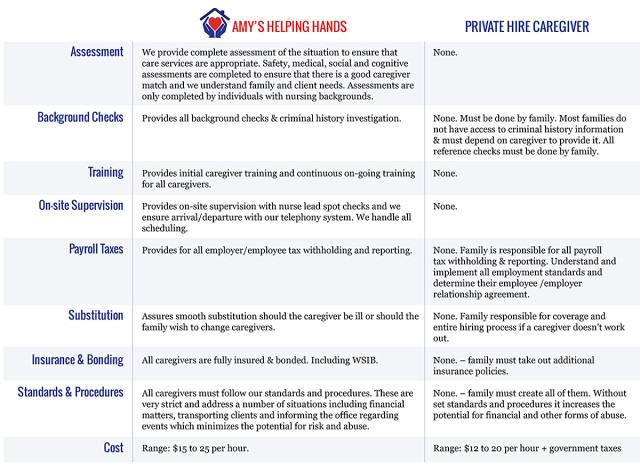

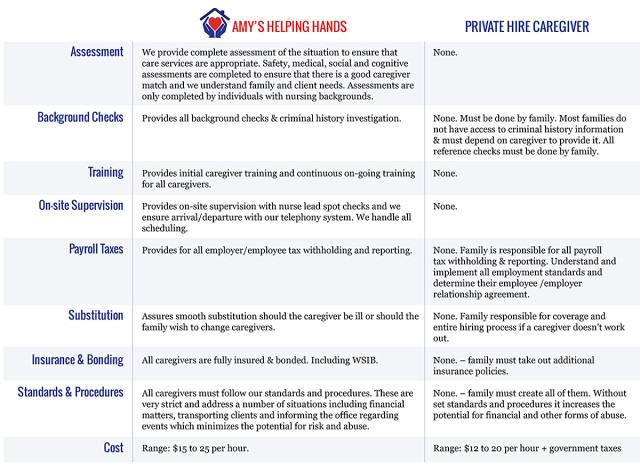

Select the Comparison Chart below to view the larger version:

All of the above issues and risks add to the complication of providing care for your loved one and as a result quality of care may suffer; you may increase financial risk, additional time, stress and burden on the family in organizing, hiring, scheduling and paying private caregivers.

After you factor the additional payroll costs, time burden and potential additional risks the cost of hiring privately there are many advantages to consider an agency to provide care.

To learn about some of the benefits of using Amy's Helping Hands visit Why Choose Us.

*The content of this page is for information purposes only, it is recommended that you seek advice from both legal and accounting professionals pertaining to any contracts, Canada revenue agency, tax, legal, or employment standards act related matters.